Digital technology transforms everything it touches—even if some sectors have proven more resistant to change than others. You might expect the field of electrical diagnosis to have been first in line adopting the advantages of digital transformation. But sometimes it takes a specific problem, the right conversation and a clear vision to push things forward.

Case in point: It took a phone call to get factory floor veteran—and admitted “non-electrical guy”—Ryan Pike thinking about new ways to streamline and improve factory line diagnosis.

Ryan became one of the primary forces behind TRACER—Tweddle Group’s electrical diagnosis platform. And in the years since that phone call, TRACER has digitally transformed the factory floor with its ability to diagnose complex Diagnostic Trouble Code (DTC) failures with astonishing speed and accuracy.

We sat down with Ryan to discuss that phone call, the development of TRACER, and an infamous dumpster full of ruined instrument panels.

Just to start, Ryan, could you tell us a little bit about your background? What did you do prior to joining the team at Tweddle Group and working on TRACER?

Ryan Pike: So, I’ve been in the automotive space for 37 years now, actually, first working in a factory at Dana Corporation, a drivetrain company. I became the line supervisor while I was still in college. Before I graduated, Dana hired me into their Sales & Marketing department. This was basically business development for things we didn’t have under contract at the time. We were looking for opportunities to grow the business.

From there I moved into operations and global management.

I also did stints in operations with various companies. I set up a few factories, ran a few factories, and was immersed in manufacturing for about 7 years.

One experience that had a strong impact on me was working at Bill Davidson’s Guardian Industries. I handled oversight for core research and development programs. My role was taking inventions we had under patent and pairing them to the appropriate markets. That’s where I got my first crack at growing new technologies into new markets with new clients. You’d say, “There’s a space and demand here. What do we have in our product portfolio to add value and address the market needs?” It was blank canvas assignment, really exciting.

I also did some work with Electric Vehicles for about 4 or 5 years out in California. This was in the Tesla plant, developing their interior—the instrument panel and the seating. I started and ran that section of their factory.

All that experience had to shape your understanding of the manufacturing environment. Did that prepare you for looking at how technology might support and grow the manufacturing side of a business?

Yeah, for sure. Interestingly enough, and not by design.

“The DTC told them there was a problem, but they couldn’t map it visually for electrical diagnosis—not accurately, not quickly, and not consistently.”

So, you arrive at Tweddle Group. From there, how did TRACER come about?

Necessity is the mother of invention, you know. I remember Tweddle Group’s then-CEO, along with Pat McGinnis, coming to me. This is around 2016. They said, “We got this phone call from Mahle. They’ve got a client, Ford Motor Company, and they have a problem in their factory. They get DTC codes, but they don’t currently have a way to map these issues to specific components. Can Tweddle Group help?”

So that’s what we started with, that was the problem statement.

But that’s kind of like going to the doctor and finding out your blood pressure is 140 / 95. Think of that blood pressure value as analogous to a vehicle kicking out a cluster of diagnostic trouble codes. There’s a problem, right? But you don’t necessarily know what’s causing it. Is it your diet? Is it cholesterol level? What’s your physical condition? Are you under a lot of stress? What in your body is causing this indication of trouble?

Right.

They were getting irregular blood pressure results, so to speak, but they were at a loss. The DTC code told them there was a problem. But they couldn’t map it visually to a specific location in a vehicle for electrical diagnosis—not accurately, not quickly, and not consistently. And that was hampering their ability to conduct the repair and, more importantly, avoid it in the future.

Was that the official assignment, then?

Yes. “What can we do to help in this space with this particular issue using our core skill set and in-house expertise?”

We started talking to Mahle by asking some basic questions. We started looking at the total population of the information that was already available.

That’s when Pat McGinnis put me in touch with Sergio [Zaccherini, initially out of Tweddle Group’s Italian office, on assignment in America], to see if we could brainstorm a solution. Sergio has this vast experiential knowledge. We quickly realized, “The client already has all the data and information they need to do this job. We just have to find a way to stitch it together, to generate meaningful output on the factory floor.”

Did you have a specific end goal in mind at this point?

It was taking shape. Sergio and I discussed the situation, the issues involved and sort of what I was picturing. Sergio works on a deep, technical level. He’s all about how things would work versus what it would look like on the surface. He methodically works out the mechanics and tactical concerns of a problem to find a solution.

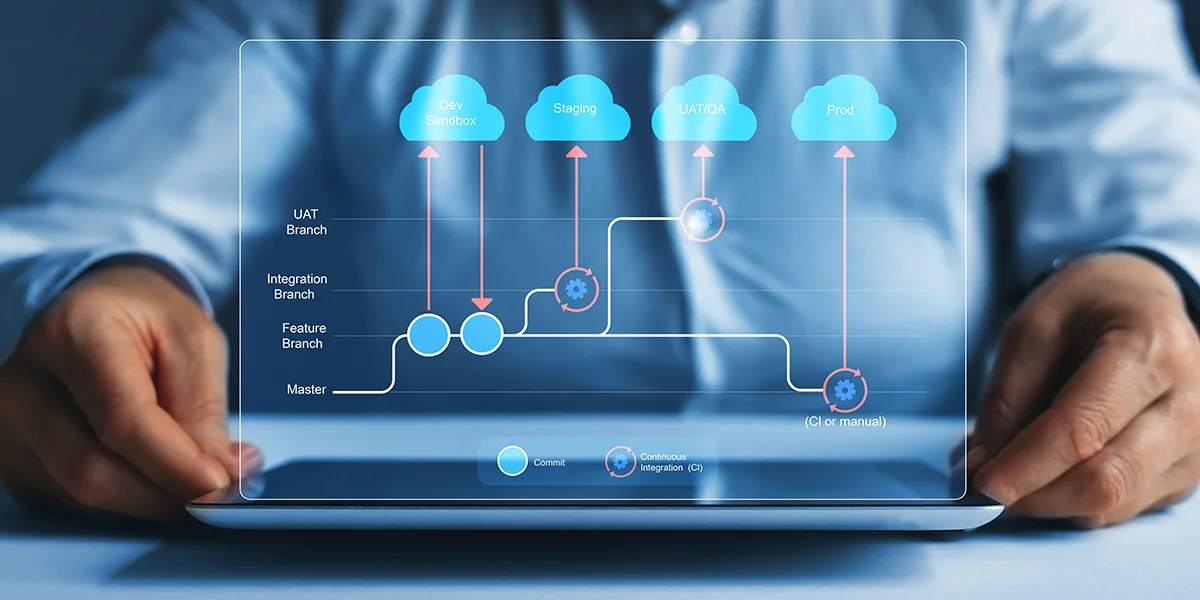

We storyboarded a mile-high view. Where—in the assembly and pre-assembly process—would we need to secure the information we needed? The ultimate challenge for TRACER—or any other technology of this type—is to get accurate, repeatable, complete data in a timely fashion. Without that, you’ve got an engine with no fuel.

So we said, “What if we had a vehicle view with CAD imagery? What if we had power-to-ground circuit views with all related splices, components, and modules mapped in between? Maybe the splash page could look like this.”

Which is easy to sketch on an oversized whiteboard. It’s more challenging to program a software solution from the ground up. You have to account for all these variables and inputs, right? Sergio’s expertise really became central to the development process.

It needed to represent electrical diagnosis in a way that made sense for non-electrical factory repair technicians. But it also had to provide in-depth details for the very technical Engineering community within our client target base. It had to account for all the hundreds of permutations when you consider multi-DTC failure scenarios. It was a challenge. A significant challenge.

We did our first sketch maybe two days after we got the initial call from Mahle. And if you consider that sketch it’s not dissimilar from what TRACER looks like today. You have the simple folder tabs at the top with vehicle views and the circuit view. Of course, below the surface, it’s quite complex.

That’s how TRACER was born.

“It needed to represent electrical diagnosis in a way that made sense for non-electrical factory repair technicians.”

I remember you telling me very early on about visiting the factories and seeing some remarkable things. Was that around this time?

[Laughs] Yeah. I assume you’re talking about the door panels and the IPs, the Instrument Panels?

I am talking about the door panels. Tell me about the door panels.

Well, if you have high blood pressure at the doctor—just to extend that comparison for a minute—the doctor doesn’t start taking you apart. They don’t start at the top and work their way down to your feet. Fortunately, right? A doctor doesn’t immediately send you in for surgery.

But, in effect, that’s what sometimes happens in plants. It’s a high-pressure, fast-paced environment. Time is of the essence. Quality is the overwhelming priority, but you’ve got to get these vehicles through.

Often, in a conventional assembly plant repair process, you start from whatever component just failed a test. Then you work your way backward to find the root cause.

When you find the actual root cause it may be far removed in the electrical circuit from the component or module that signaled the original issue.

Sometimes they’d just, somewhat indiscriminately, take things apart closest to the perceived problem. This is an extreme example, of course. But this is very much the approach that may be taken, especially during new vehicle launches. In a new vehicle launch you don’t have that experience and tribal knowledge built up.

Long story short, yes. There was one facility where I saw a huge dumpster full of damaged parts. These parts were ruined by that hunt-and-peck style of electrical diagnosis. I thought to myself, “That’s a lot of waste. If we could curtail some of this waste, that alone would have a positive impact on profit margins.”

Was this happening at all the OEMs?

I’m not sure any OE is immune to these practices. I think this has happened at every factory at one time or another during a new vehicle launch sequence.

For example, if the side window malfunctions, it’s not unusual to disassemble the entire door panel during electrical diagnosis. You might remove an entire IP after installing it because you had a glitch on the IP dashboard. You damage a lot of pins, Christmas tree connectors and related attachment components. The accumulated cost can be immense.

Factories may realize significant collateral damage just hunting and pecking around to find a way to correct a problem.

We saw many valuable parts and assemblies cast aside. And often to find an issue that was nowhere near the failing part or the component in question.

TRACER may in fact help you to avoid this kind of damage.

“We’ve learned TRACER’s KPI dashboard is as important as its visualization tool for electrical diagnosis.”

Is that TRACER’s primary benefit, then, helping avoid collateral damage?

It’s a huge benefit, it creates massive savings. It’s a big deal.

But, for me, TRACER’s biggest innovation involves data.

Before, when they found the problem and conducted the repair, they didn’t have a simple or robust way to record that information. You want to capture that information. You should be able to reference that information in the future. That’s the ideal, so you avoid repeating the issue.

So, what we’ve learned is TRACER’s KPI dashboard is as important as its visualization tool.

By integrating the collected technician data into Tableau, our clients have a powerful tool to avoid repeating past issues. They can spot trends and sort for irregularities. It helps identify anomalies in their processes.

So, pre-TRACER, a technician would randomly dismantle a car searching for the root cause of a problem. They’d find it… and then those findings—the lessons learned, the data—all that would just vanish into the ether?

Somewhat randomly at times, yes. The old mechanisms for capturing, storing, and analyzing those data sets were not as robust as anyone might have wanted. As we came to find out, that’s really important and not something to be taken lightly!

See, the thing to remember is we hadn’t initially set out to create any kind of exponential machine intelligence. That wasn’t the task. Our goal was just mapping issues to their correct component location. That way, the technician could conduct an electrical diagnosis and repair.

But TRACER generated brand new data sets for our clients. This was a happy by-product of the process. It happened as technicians used the platform. The new data sets could be analyzed by executives and management within our client base. They could improve the manufacturing process.

Now, they pull up the dashboard in TRACER and look at the reports.

They’ll see, virtually in real-time, if “Plant X” and “Assembly Department Y” aren’t performing as expected.

It happens all the time now. Our clients use TRACER analytics in their daily, monthly, and quarterly plant management meetings. If they’re having problems with throughput or see issues with their first-time-through efficiency, they use TRACER data to pinpoint issues. They can create corrective action plans.

I said, “I understand your operation only has 8% fallout. That’s tremendous!” And the guy started laughing.

Were there any other ways TRACER surprised you early on?

TRACER’s become a way to quickly surface trends in bad parts, bad components, inconsistent assembly processes while moving vehicles downline. It lets a factory locate and fix or amend those issues. And they can do so before value is added to a vehicle on the assembly line.

It’s created a proactive approach to electrical issues, and larger process issues, too. It helps ensure they don’t have more shots on goal in the future related to the same issue.

And that’s a critical end-goal here—to eliminate repeating the same issues over and over.

Now, at this point in our timeline, we’re still talking about what was happening in the factory, largely in new vehicle launches, right? Do I understand correctly—was all this happening before the vehicles had even left the factory?

Yes, absolutely.

Yes, absolutely.

And the metrics varied from week to week. But once OEMs were using the platform they started identifying a surprising number of faults that could be easily corrected.

Once you’d proved the general concept, what happened next?

Well, we started canvassing the market to identify common threads from one manufacturer to another. We started learning some things we didn’t expect, and some things the OEMs didn’t expect, either.

Here’s an example.

One company, their plant manager came in. He said, “Oh, we have less than 8% fallout when we launch a new vehicle.”

I was blown away.

I said, “Wow, that’s fantastic, you guys are world class.” Because most rates were in the 20 to 35% range, but this manager said, “Nope, we’re looking at 8%.” Eight percent. Incredible!

But here’s the thing.

Later that same afternoon, we had a workshop with the repair technicians from the repair bay.

And I said, “I understand your operation only has 8% fallout, that’s tremendous!”

And the guy started laughing.

He goes, “Who told you that?”

I said, “The plant manager.”

And the technician responded, “A third of the vehicles we manufacture come to us for repair. Those issues are predominantly electrical diagnosis.”

I thought, OK, well, that’s a different message than we got.

So, we came to recognize it’s a common problem, and that plant management sometimes doesn’t want to admit it.

END OF PART 1

In Part Two, Ryan Pike discusses TRACER’s expansion, how the software could help dealerships, and what he sees as the future of the platform.

Special thanks to the Office Coffee Shop, Royal Oak, MI, for hosting our chat with Ryan